Oct 11, 2021

Meme stocks and cryptocurrencies might be dominating the news cycle, but ETFs have been the unsung heroes of the retail investor revolution. Not only have they proved indispensable in low-cost passively managed accounts offered by platforms like Betterment and SoFi, but they are also used to execute active trading strategies on retail platforms like Robinhood and e-Toro (incidentally, all these firms are Xignite clients). Whether one is looking to capitalize on a geographic, sector or, economic trend, ETFs are highly accessible to trade.

Strategies that were long reserved for professionals can now be easily executed by retail traders. Such strategies include sector rotation, emerging market bonds, and hedge fund strategies among others.

With the growth of ETF offerings, some of which are highly targeted, comes the problem of searching, screening, and comparing which ETFs are right for a given strategy. With more than 2,500 ETFs in the US alone, surfacing the right ETF is akin to finding a needle in a haystack. It’s critical for our clients to have institutional quality ETF data integrated into their financial software and mobile applications.

Xignite’s new ETFs analysis API is designed to power even the most demanding ETF screening applications. You can dramatically increase engagement and trading revenue by making it easy to find ETFs that match investors’ market outlook. The granular data and streamlined API design will help you build and launch ETF products in a matter of weeks.

Let’s take a look at a few popular ETF groups and see the advantages. Characteristics fields specific to each category are shown in the example output.

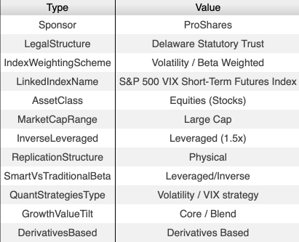

Leveraged and Inverse Leveraged ETFs

SQQQ, TQQQ, UVXY are among some of the highly traded ETFs. The example below is provided for UVXY, ProShares Ultra VIX Short-Term Futures ETF. You can easily see the leverage multiple with InverseLeveraged field with the Xignite GetETFCharacteristics endpoint.

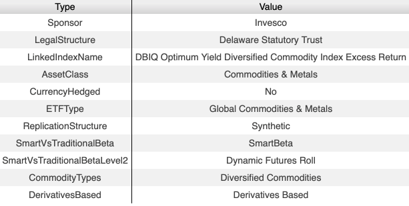

Commodity ETFs

DBC, GLD, PDBC, COMT have been popular. The example below is provided for DBC, Invesco DB Commodity Index Tracking Fund. CommodityTypes defines which types of commodities a particular ETF targets.

Hedge Fund Strategies

HedgeFundType field in the Xignite GetETFCharacteristics endpoint lets you find Active and Passive ETFs that follow one of these strategies: Event Driven, Long/Short, Macro Strategy, Merger Arbitrage, or Multi-Strategy. The example below is provided for RWGV, Direxion Russell 1000 Growth Over Value ETF.

ESG focused ETFs

SocialEnvironmentalType field in the Xignite GetETFCharacteristics endpoint screens for ETFs with an environmental focus.

The example below is provided for GRID, First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund.

Emerging Market Bonds

The example below is provided for EMB, BTC iShares J.P. Morgan USD Emerging Markets Bond TF.

In addition to the highlighted characteristics fields, full daily holdings flows since inception, navs, trailing returns and extensive reference data are available in XigniteGlobalETFs API.

Xignite’s ETFs API provides a rich dataset with a simple structure so that you can focus on the innovation that drives engagement.

If you are interested in learning more about our new ETFs API, please contact sales@xignite.com.

[Case Study] SoFi

Learn how SoFi Increased Client Engagement 25% in a Day